Order Management Systems (OMS) are crucial for traders and brokers in today’s financial markets. They help manage the entire lifecycle of an order, from reception to execution and settlement. This blog post will explore the key features of an OMS, the challenges they address, and emerging trends shaping their future.

Key Features of an Order Management System (OMS) for Traders and Brokers.

An effective OMS should offer a wide range of features to facilitate efficient and streamlined trading operations. Some of the most important features include:

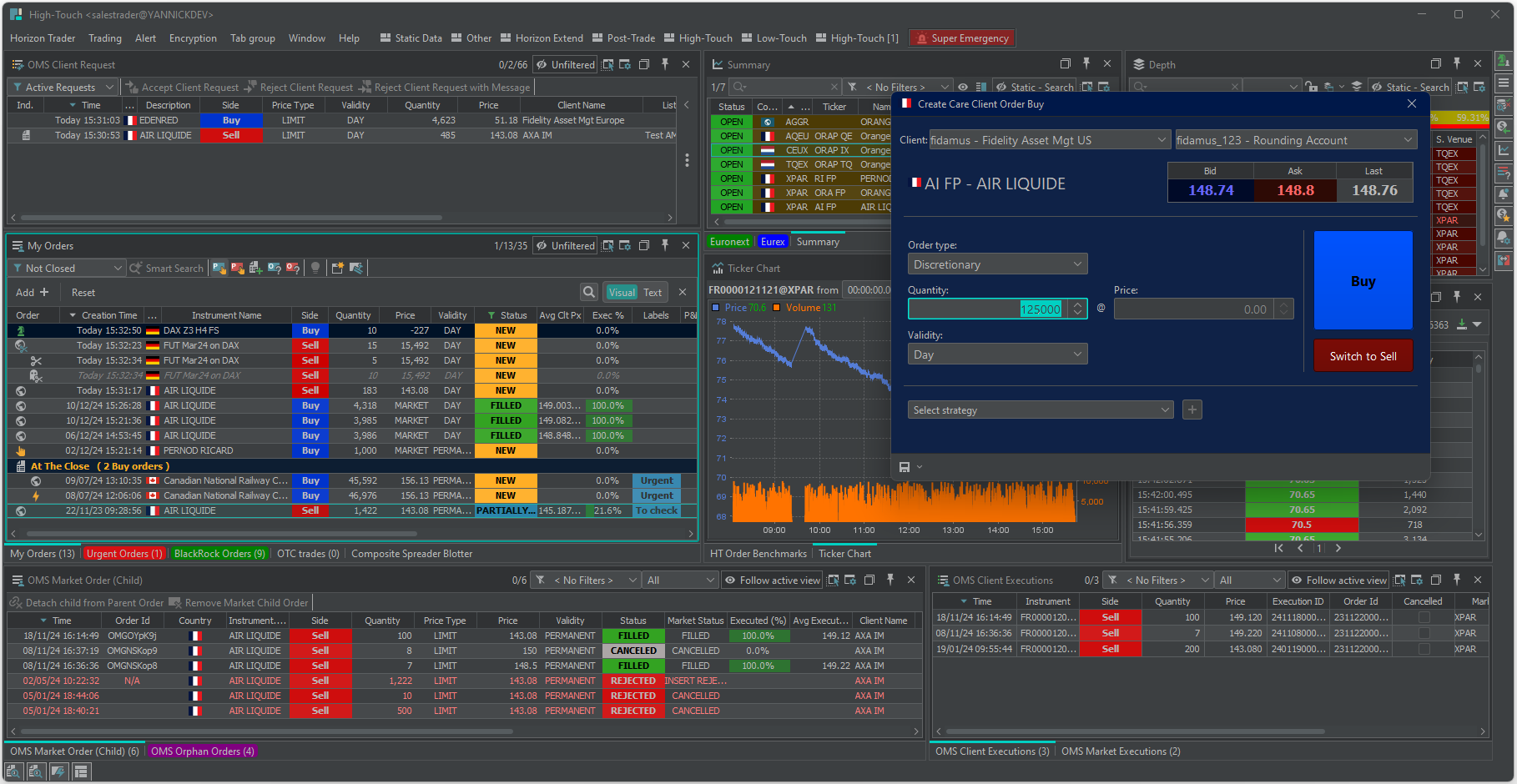

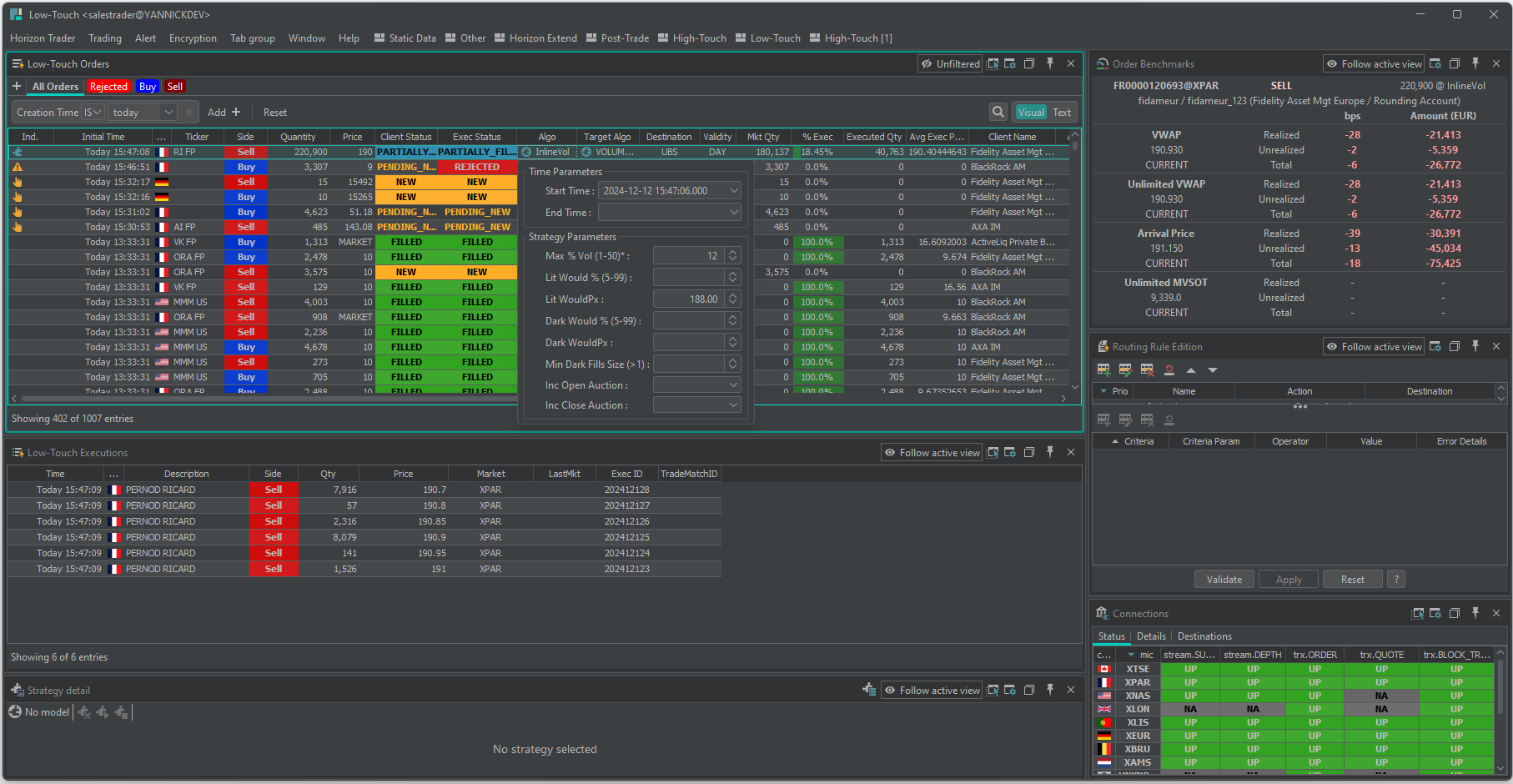

- Workflow Flexibility: A modern OMS should be able to handle both high-touch (manual) and low-touch (automated) workflows seamlessly. It should allow for customization and segmentation of workflows based on client needs, regions, and trading activities.

- Access to Data and Information: Real-time access to market data, analytics, client positions, commissions, transaction history, and algorithm performance are critical. Traders need this information to make informed decisions and provide effective execution services and advice.

- Automation and Alerting System: With increasing trade volumes and fewer human traders, automation is key for efficiency. An OMS should automate tasks like order booking, allocation, and routing. An alerting system should highlight critical issues and opportunities, allowing traders to focus on orders requiring attention.

- Customizable FIX Connectivity: For agency trading, the OMS should facilitate seamless onboarding of clients via FIX, managing static data, risk controls, and connections. It should support various FIX versions and offer customization options.

- Pre-Trade Risk Check: A robust pre-trade risk engine is essential to manage regulatory and counterparty risks. This engine should enforce checks on client funds, positions, and commitments. Features like non-blocking risk controls and rejection alerts help mitigate potential risks.

- Post-Trade Regulatory Reporting: The OMS should ensure the export of all necessary data for regulatory compliance. This includes real-time and end-of-day data export in formats compliant with regulations like MiFID.

- Integration with External Systems: A modern OMS should seamlessly integrate with other systems, including market data providers, risk management systems, and reporting platforms. It should support various data formats and communication protocols.

- Algorithm Integration: The ability to integrate and execute algorithms is becoming increasingly important. An OMS should offer pre-built algorithms like TWAP and VWAP, and allow clients to develop and integrate their own algorithms.

How Order Management Systems (OMS) Solve Trading Challenges

Modern OMS platforms help traders and brokers overcome various challenges inherent in today’s complex trading environment:

- Latency Issues: Manual tasks and inefficient workflows can lead to significant latency in order processing. An OMS automates these tasks, reducing latency to milliseconds for DMA and minutes for manual workflows.

- Need for Customization: Every broker has unique requirements, business models, and regulatory obligations. An OMS should be modular and flexible, allowing customization to adapt to specific needs.

- Complex Workflow Management: Managing diverse order types, lifecycles, and execution methods can be challenging. An OMS provides tools to manage these complexities, offering traders control and visibility over the entire order lifecycle.

- Simplification of Client Onboarding: Integrating new clients, especially those using FIX, can be time-consuming and technically demanding. An OMS simplifies this process by providing tools for automated configuration and testing of FIX connections.

Emerging Trends Shaping the Future of Order Management Systems (OMS)

The OMS landscape is constantly evolving. Some of the key trends shaping the future of OMS include:

- AI Integration: Artificial Intelligence (AI) is poised to play a significant role in OMS by automating tasks, detecting patterns in trading data, and optimizing operational processes.

- Crypto Trading: The rise of cryptocurrencies requires OMS platforms to adapt and support crypto trading operations. This includes managing unique characteristics of crypto markets like 24/7 trading and different settlement mechanisms.

- Reduction of Settlement Time: Shorter settlement cycles demand faster processing and booking of trades. OMS systems need to evolve to ensure real-time transaction processing and reconciliation.

- Interoperability of Trading Screens: The need for a unified workspace with seamless interaction between applications from different vendors is growing. OMS platforms need to integrate with other trading tools, allowing data exchange and coordinated actions.

- Integration of the Algo Wheel: This feature, commonly found in buy-side OMS, is expanding to the sell-side, allowing brokers to distribute and access algorithms from various sources.

Why Horizon’s OMS is the Ultimate Solution for Agency Trading

Horizon’s OMS stands out for its comprehensive features and adaptability. It addresses the challenges discussed above while embracing emerging trends. Some of its key strengths include:

- Unified Platform: Horizon’s OMS seamlessly integrates agency and market-making workflows, providing a single platform for all trading activities. This eliminates integration challenges and offers a richer feature set.

- Workflow Automation: Horizon excels in automating workflows, reducing manual intervention and enhancing efficiency. Its rule-based system allows for custom automation of tasks like order booking and allocation.

- Algorithm Integration: Horizon offers both pre-built algorithms and the flexibility to develop custom algorithms using Horizon Extend. This empowers clients to create and implement sophisticated trading strategies.

- Multi-Asset Class Support: Horizon’s OMS handles a wide range of asset classes, including derivatives, fixed income, and structured products. Its strength in derivatives is particularly noteworthy, leveraging Horizon’s expertise in market-making.

- Direct Connectivity and Efficient Data Management: Horizon’s OMS efficiently manages large instrument dictionaries, particularly for derivatives, options, and futures. Its direct connectivity and optimized data management reduce resource requirements and enhance performance.

- Customizable API and Proprietary Strategy Implementation: Horizon provides a robust API for integration with external systems and development of custom functionalities. Horizon Extend allows clients to implement proprietary strategies while protecting their intellectual property.

- Modular Design and Customizable UI: Horizon’s OMS is highly modular, allowing clients to activate only the necessary features. Its UI is highly configurable, offering flexibility and continuous improvement in ergonomics and user experience.

Why Order Management Systems (OMS) Are Indispensable for Modern Trading

An OMS is an indispensable tool for traders and brokers in today’s dynamic financial markets. The features and capabilities of an OMS are constantly evolving to address new challenges and leverage emerging technologies. Horizon’s OMS is a powerful and versatile platform that provides a comprehensive solution for managing the entire trade lifecycle, from order reception to settlement. By embracing innovation and focusing on client needs, Horizon is well-positioned to lead the way in the future of OMS technology.

Customizable order dialog

Enhanced order benchmarking

Want to learn more about Horizon’s Order & Execution Management System (OEMS)?

Download the brochure: