In the fast-paced world of finance, where milliseconds can make or break a trade, having the right tools is essential. One such tool that has become indispensable for institutional investors, asset managers, and trading firms is the Order Management System (OMS). But what exactly is an OMS, and why is it so critical in today’s trading landscape? In this article, we’ll break down everything you need to know about OMS platforms and how they can transform your trading operations.

What is an Order Management System (OMS)?

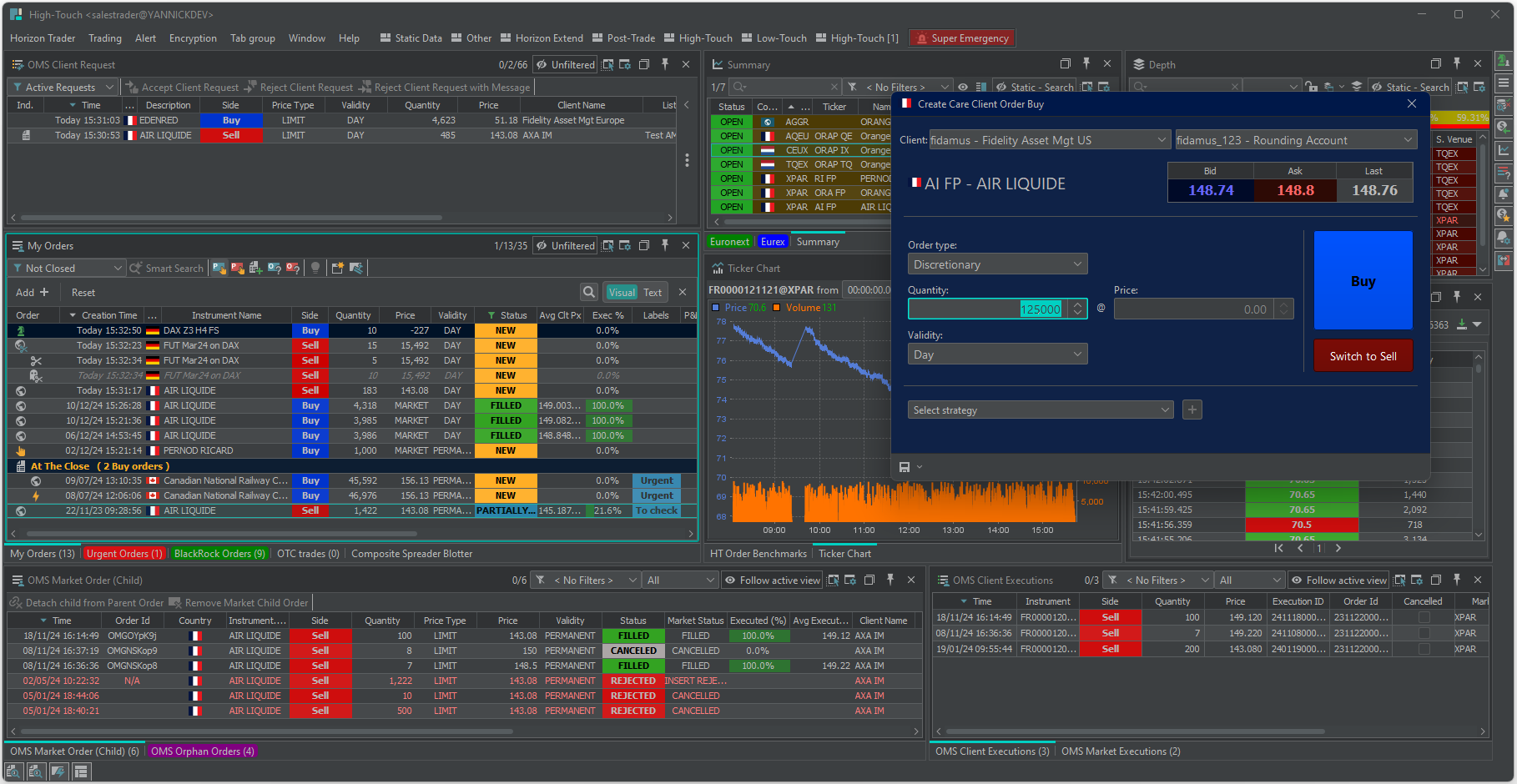

An Order Management System (OMS) is a sophisticated software platform designed to streamline the entire lifecycle of trade orders. From order entry and execution to compliance and reporting, an OMS acts as the central hub for managing trades across multiple asset classes, including equities, fixed income, derivatives, and forex.

Think of an OMS as the “brain” of a trading operation. It ensures that orders are executed efficiently, comply with regulations, and align with your investment strategy—all while providing real-time visibility into your trades.

Key Features of an Order Management System (OMS)

Here’s a closer look at the core functionalities of an OMS:

- Order Entry and Routing

- Easily input buy/sell orders and route them to the best execution venues, such as exchanges, dark pools, or brokers.

- Supports advanced order types like market orders, limit orders, and stop-loss orders.

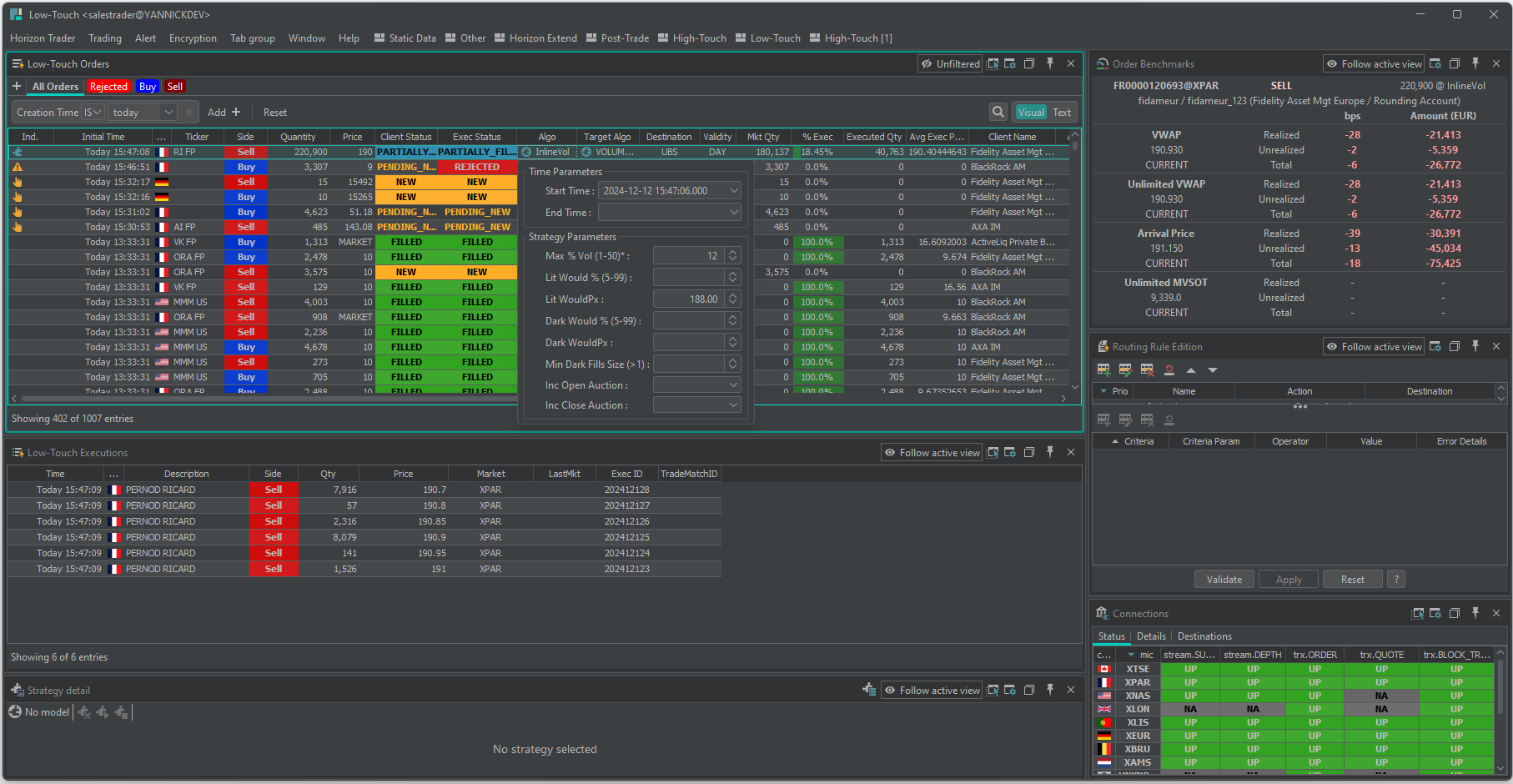

- Real-Time Order Tracking

- Monitor the status of your orders (open, filled, partially filled, or canceled) in real time.

- Gain visibility into trades across multiple markets and asset classes.

- Compliance and Risk Management

- Automate pre-trade and post-trade compliance checks to ensure adherence to regulatory requirements.

- Set risk limits to prevent overexposure or unauthorized trades.

- Integration with Execution Management Systems (EMS)

- Seamlessly connect with EMS platforms for advanced trading strategies, algorithmic trading, and access to liquidity.

- Trade Allocation

- Allocate trades across multiple accounts or funds fairly and efficiently.

- Reporting and Analytics

- Generate detailed reports on trade execution, transaction costs, and order performance.

- Gain insights into trading patterns and market impact.

Why Do Traders and Investors Need an Order Management System (OMS)?

In today’s complex and highly regulated trading environment, an OMS is no longer a luxury—it’s a necessity. Here’s why:

- Efficiency: Automate manual processes, reduce errors, and save time.

- Transparency: Gain real-time visibility into your trades and execution quality.

- Compliance: Stay ahead of regulatory requirements and avoid costly penalties.

- Scalability: Handle high volumes of trades across multiple markets and asset classes.

- Cost Savings: Optimize trade execution to minimize transaction costs and market impact.

How to Choose the Right Order Management System (OMS) for Your Needs ?

With so many OMS platforms available, selecting the right one can be challenging. Here are some factors to consider:

- Asset Class Coverage: Ensure the OMS supports the asset classes you trade (e.g., equities, derivatives, fixed income).

- Integration Capabilities: Look for seamless integration with your existing systems, such as EMS, risk management, and accounting platforms.

- User Interface: Choose an intuitive and user-friendly interface to enhance productivity.

- Customization: Opt for a platform that can be tailored to your specific trading strategies and workflows.

- Vendor Reputation: Select a trusted provider with a proven track record in the industry.

Why Choose Horizon Trading for Your Order Management System (OMS) Needs?

At Horizon Trading Solutions, we understand the unique challenges faced by traders and investors in today’s dynamic markets. Our cutting-edge OMS solutions are designed to empower your trading operations with:

- Unmatched Speed and Reliability: Execute trades with precision and confidence.

- Advanced Compliance Tools: Stay compliant with evolving regulations.

- Seamless Integration: Connect with your favorite platforms such as analytics…

- Dedicated Support: Our team of experts is here to help you every step of the way.

Whether you’re a bank, broker, asset manager, or institutional investor Horizon Trading has the tools and expertise to take your trading to the next level.

Ready to Transform Your Trading Operations?

An Order Management System (OMS) is more than just a tool—it’s a game-changer for traders and investors. By streamlining workflows, ensuring compliance, and providing real-time insights, an OMS can help you stay ahead in today’s competitive markets.

If you’re ready to explore how an OMS can benefit your business, download the brochure here.

Customizable order dialog

Enhanced order benchmarking